Regardless of the industry, all businesses should be covered by insurance. Protecting the business that you have worked so hard for is essential. You should know the different risks and how to avoid them is crucial before you open your leather business. Always remember that building a company is hard work and comes with plenty of risks.

What is the business insurance for a leather business? General liability, business owner’s policy, commercial property, and product liability insurance are just some of the policies you need to consider. With these coverages, you can ensure safety with your leather business.

There are plenty of unforeseen circumstances that can happen, such as this COVID-19 pandemic. This article will discuss the different business insurance you should get as a small business and as a growing company. It will also talk about the different risks that you have to consider when starting a leather business. Lastly, I will talk about the purpose of insurance and additional factors to consider in protecting your leather business.

Types of Business Insurance You Should Get

Knowing the right business insurance to get for your leather business is important. It can save you a lot of money and peace of mind when you have your business running.

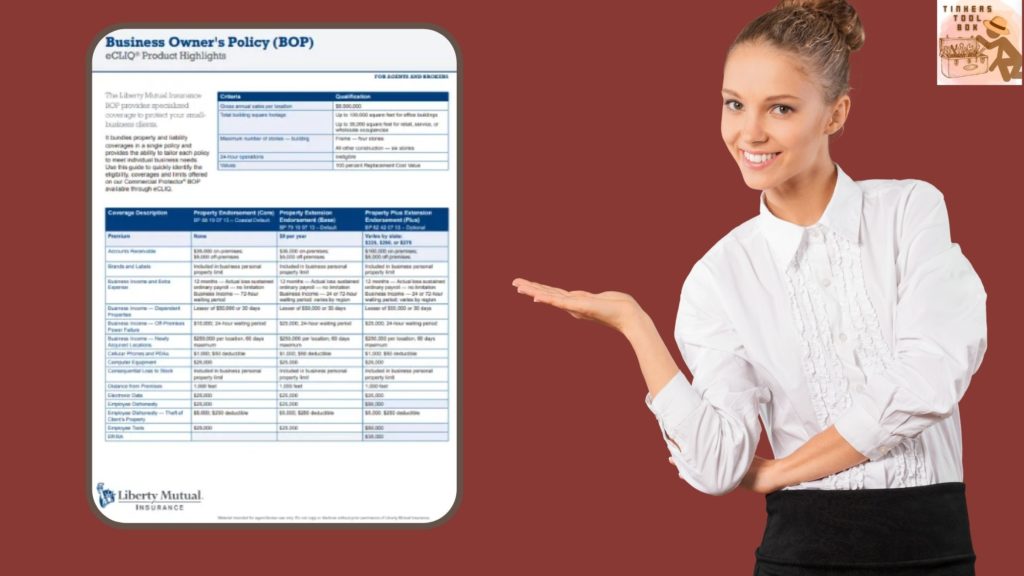

The Business Owner’s Policy or BOP Insurance

The Business Owner’s Policy or BOP Insurance is the combination of business property and business liability insurance into one. It also covers your business from claims that result from things like fire, theft, or other covered disasters. This insurance will help cover the claims that may arise from your business operation.

These claims would include bodily injury or property damage that you may have in your leather business. With this insurance, you have an option to add optional coverages such as data breaches, business income for off-premises utility services, and other specialized coverages.

Now, the BOP is great insurance to have because it can be custom-made to fit your leather business needs. This type of insurance is known as package policies that you can get for an affordable price. Customizing your insurance is the first step you should always do when planning to open any type of business.

The price of the Business Owner’s Policy Insurance ranges from $500 to $3500 a year.

When Do You Need a BOP

The best time to get BOP is when your leather business has a physical location. No matter where you conduct your business, what matters is your business and assets have coverage. However, if you are still operating from home, you can take advantage of BOP insurance as well. It will also cover any rented or owned location that you may have, store or garage, as long as you use it for your business.

Remember, when you own a business, there is always the possibility of being sued. Without the proper coverage, you may be looking to have hefty out-of-pocket fees if any incident may happen. You would need BOP insurance to cover customer’s or employee’s medical expenses.

Now, assets can be stolen or damaged, and they may be hard to replace. You also have to worry about digital assets and customer data, equipment, furniture, cash, or inventory. These are some of the things that may be hard to replace, and that’s when you need insurance to cover any of your losses.

With BOP, there’s no need to worry about where the money is coming from in the event your goods are stolen or damaged.

Optional Coverage That You Can Avail

As I’ve mentioned above, there is optional coverage that you can take advantage of when it comes to your BOP insurance. Small businesses are highly recommended to avail of this optional coverage since you want to protect the business that you have just started.

The first optional coverage that you can get is Employee Dishonesty. It is always a business owner’s expectation to find employees that are honest and trustworthy. However, it is not always the case, and if you have a situation where an employee steals from a customer, the Employee Dishonesty coverage will kick in. It will reimburse the business for the amount that is needed to satisfy the customer.

Second, the Money and Securities coverage wherein in case there’s money stolen either on or off premises this will reimburse the business up to the covered amount. There are different amounts of coverage that you can choose from, so make sure to talk to your agent about this.

The third optional coverage is Outdoor Signs. Now, most stores spend a hefty amount of money on the signs on their property. These signs can be damaged by different weather such as windstorms, lightning, and so much more. When you have this coverage, the insurance will cover the repair and replacement amount for your signs.

Lastly, there is the Equipment Breakdown wherein case your systems fail, such as HVAC systems, the insurance company will reimburse the expensive repairs or replacement for them.

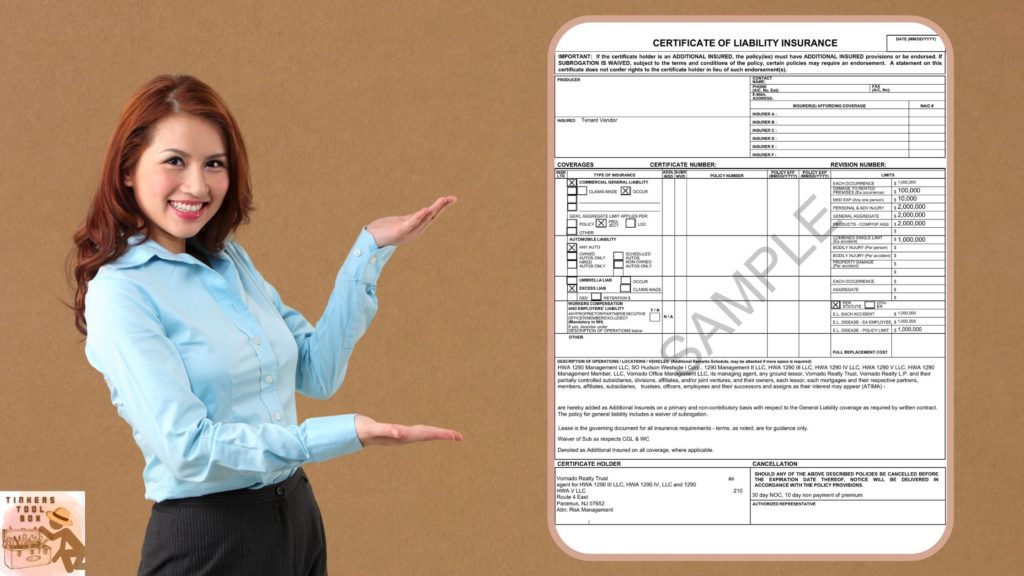

The Commercial General Liability Insurance

General Liability Insurance is one of the most common and comprehensive insurance that you can get for your leather business. Most business owners invest in this type of insurance because it covers the following: bodily injury, property damage, medical payments, legal defense, and judgment, as well as personal and advertising injury.

Now, it is not legally required to carry this type of insurance but operating without it poses extreme risks. When your business is sued, you can end up with thousands of dollars or more in fees. This type of insurance helps compensate for the damages.

In order to claim this insurance, you must show evidence of your liability insurance as part of the application. When purchasing General Liability Insurance, you have to make sure to talk to the best agent. Ensure you know about all the specifics to avoid any blind spots.

The cost of the General Liability Insurance is $350 to $750 per year. Here you will have a million-dollar in coverage which will cover your location, deductible, number of employees, per-occurrence limit, and general aggregate limit.

You can get a discount rate if you purchase this insurance as a part of the Business Owner’s Policy (BOP) to save more money.

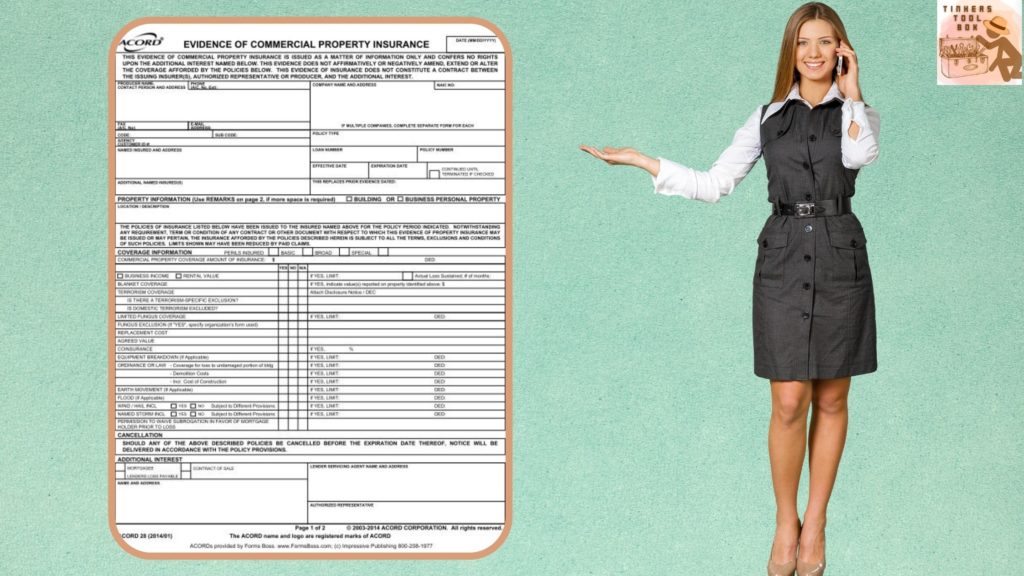

Commercial Property Insurance

When your property is hit by disasters like vandalism, nature, or theft, the Commercial Property Insurance will cover your financial losses. This policy covers your building, machinery, raw materials such as hides and skins, finished leather goods. The policy will pay to repair or replace any owned physical property.

It will also cover any business-owned assets that are kept onsite. Just like the General Liability Insurance, this can be purchased with BOP. It is much cheaper when purchased with the package rather than standalone insurance.

An excellent example of this insurance is if a circuit breaks, malfunctions, and starts a fire. When the fire spreads, it can ruin all of your belongings. These belongings would cover everything that has been destroyed as well as the replacement costs that it comes with.

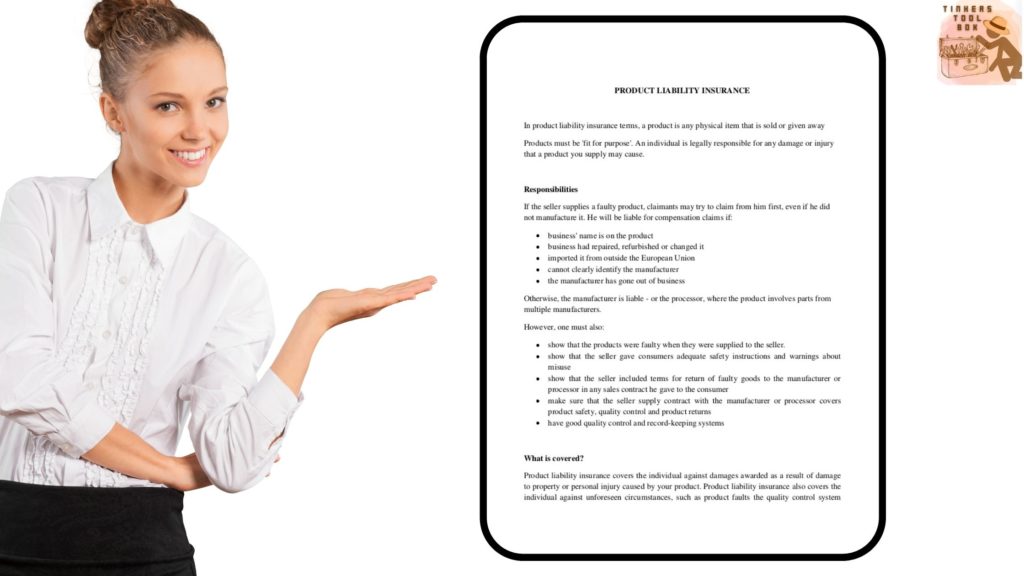

Product Liability Insurance

Product Liability Insurance is for those who have manufacturing, supplying, or selling products which is the perfect fit for a leather business. If there will come a time that illness or injury from the product happens, there’s a good chance it can lead to a lawsuit.

This insurance will make sure to cover any legal fees that you may be facing as well as any damages awarded by the court. Now, getting the Product Liability Insurance would depend on the type of leather goods you make in your business. It is best to speak with an insurance professional to know the important details and see if this is a tailor-fit to your business.

Best To Add When Company Has Grown

The following insurances would be best to add if your company has grown out of the small business category.

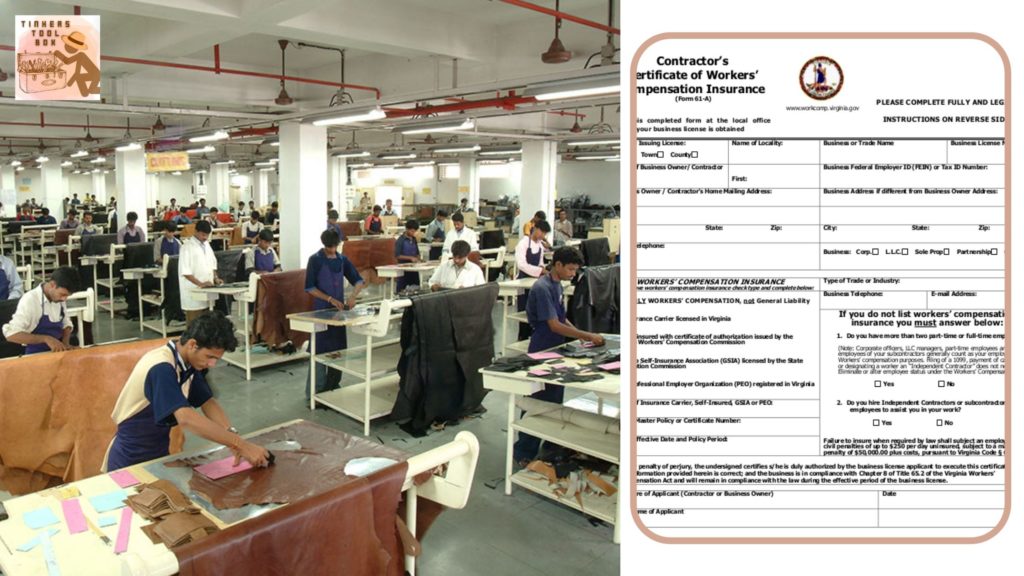

Workers Compensation Insurance

Never forget your employees because they are what makes your business grow and function. When an employee is injured or falls ill while on the job, this insurance will cover the employees’ medical bills and any lost wages.

It also covers the business owners’ legal fees when the employee decides to bring a lawsuit against you for the incident. The Workers Compensation Insurance can be bought as standalone insurance.

The price of this insurance covers a wide range of prices, and it depends on the state where you have your business. Estimating the cost for the insurance would depend on the type of work, payroll, location, and history claims. For example, $0.57 in Texas per $100 of covered payroll, then do the math, you will get the amount you need to pay for the Worker’s Compensation Insurance.

Commercial Auto Insurance

Commercial Auto Insurance helps pay for any work-related auto accidents that may happen. The best time to get this insurance is if you have delivery vans or trucks that are used for your business. Vans and trucks that you or your employees are using would be covered in this insurance.

For a Commercial Auto Insurance policy of $1 million, it would cost $142 per month, which is a total of $1,704 per year. It is a hefty amount, so the best time to get this is when your leather business is stable and doing good.

Professional Liability Insurance

Professional Liability Insurance is also known as errors and omissions insurance. It helps protect the company against claims stating your professional services. It also covers any incident that may cause financial harm.

The basic $1 million policy ranges from $300 to $1,000 per year. The price would depend on different factors that go into the insurance policy.

Cyber Insurance

Cyber Insurance covers any data breach risks that you may experience in your leather business. It helps pay for liability costs and protects your business’s identity. It will cover any legal fees and public relations you may have regarding cyberattacks or data breaches.

Now, the price for Cyber Insurance would depend on different risk factors that a particular business has. Annual policies may range from $500 to $5,000 or even more.

Know The Risks In Leather Business

Since you are still starting, you should be aware of plenty of risks in your small business.

Biggest Risk: Financial

The biggest risk that you have to face when you have a small business is financial. Most owners invested their life savings or took out significant loans to start their business. There is a lot of pressure to become successful in your chosen business.

One of the biggest concerns at the beginning of every small business is cash flow. You need to consider where the money will come from and where you would get the cash to maintain operations, pay employees, and invest in market penetration as well as growth.

Now, depending on your location, some may need low-cost upfront while others require a higher cost upfront. For instance, if you plan to run your business at home, it would have a low-cost upfront, while a physical location will have a higher cost.

You also have to keep the economic condition in mind because a recession can damage the most wealthy organization. Aside from that, it would help if you considered the current and future climate of the business. It is best to start the business during prosperous times, allowing you to save excess cash and negotiate favorable purchasing terms.

Strategy Risks

When it comes to a new business, it is hard to know the steps to take. If you don’t have a formalized decision-making process in place, it can be challenging. Each stage of your business life cycle has its challenges. You must have an ideal structure, target market, sales and marketing strategy, and so much more.

Shifting the external environment is also a factor that you have to consider and can be a risk. It means when competitors appear or change and may begin to offer similar products or services. There can also be a shift in technology which can present a new opportunity or render current processes that are obsolete. In this case, new regulations should be enforced.

To address this type of risk, you should have plenty of research and planning. Brainstorm risks that may arise and prioritize them. Ask what you should do to mitigate each risk and what you should do. Make sure to conduct research based on industry trends, competitors, and prior experience.

Always work towards improvement and go back to the list you’ve made at least once a year. Also, make sure that you are on track, and the list should be current as well as accurate at all times.

Business Interruption Risks

A business interruption risk is when small businesses can be disrupted at any time. The perfect example of this is the COVID-19 pandemic. Natural disasters will also go in this category of risk where it makes it impossible to go into the office because of severe damage to inventory or equipment.

When you have a small team, illness could interrupt operations for about a day or two. Another risk that you have to consider is the supply chain. Most businesses rely heavily on others to manufacture their products, such as a leather business. Also, lean business models become more pervasive, and small businesses should be prepared and practice continuity plans.

This plan often includes the response to a crisis, assigning roles to all members of the business. Make sure to quickly react to minimize the impact of interruption to retain customers and the business’s reputation. Once interruption is over, make sure to get back on the right track quickly.

Security Risks

The number one security risk that you need to be aware of our cyber risks poses a significant threat. These risks also include financial loss, disruption, or reputational damage to businesses and can come to be a failure to the IT systems.

Hackers are increasing and have become skilled as well as sophisticated nowadays. Today, businesses are collecting more than personal data from customers, which is a big risk. Having a formalized risk management from the start of a business is the key. It doesn’t have to be perfect, but you need to consider all the risks and plan for how they will be solved in the future.

You also need to learn how to reduce risk-related costs, which are insurance premiums, claims deductibles, and downtime. Good risk management will protect the reputation of the company and help it plan for contingencies. It will make the business more profitable and ensure the longevity of your company.

Liability Risks

All types of businesses are subjected to liability risk, but the most vulnerable are small businesses. You may not have the resources to pay for damages which can risk cash flow effectively. When it comes to employees or customers, injuries, property damages, failure to meet contractual obligations can occur. These are just some of the liability risks that you may encounter.

These risks can lead to costly lawsuits and fines. Ensure that you find insurance agents or brokers who have experience and a good reputation so that they can find you the best insurance coverage and terms for your risk.

Commercial Property Risks

When you have an office, production plant, and warehouse for your raw materials and finished goods, commercial property risks are present. The chemicals used for dyeing, finishing, or tanning are flammable and should be appropriately labeled, stored, and separated in approved containers.

Cutting, punching, and buffing are also part of the operations and can generate dust which can catch fire. If you don’t have a well-maintained dust collection system, the hazard increases. Loose fibers and scraps from processing leather are also combustible, which can add fuel to the load.

Also, it would be best if you remembered that leather is susceptible to damages such as fire, smoke, water, and humidity. If you have poor housekeeping, it can contribute to a significant loss to your business.

Now, leather can be high-valued and is also a target for theft. You should take security controls, which should include physical barriers to prevent entrance. With the right insurance, it should be able to cover any of the risks that are mentioned above.

Conclusion

Starting your own leather business or any other type of business is no walk in the park. You should have the proper research as well as knowledge before putting your life savings into your business. Knowing the appropriate insurance to get for your business is one of the crucial factors that you need to consider so you can avoid any hefty legal fees that may occur. Be safe with the proper business insurance coverage!